How Much Is Ctc 2025

BlogHow Much Is Ctc 2025. At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax credit, a policy that has gained. The maximum tax credit per child is $2,000 for tax year 2025.

The child tax credit (ctc) is a provision of the tax code that reduces tax liability up to $2,000 per qualifying child. You qualify for the full amount of the 2025 child tax credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000.

For the 2025 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700.

At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax credit, a policy that has gained.

Child Tax Credit CTC Update 2025, How much is the 2025 child tax credit? On january 31, 2025, the us house of representatives passed h.r.

Basic Salary Percentage of CTC Calculation Simply Explained by, President joe biden's budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc). For the tax year 2025, it would increase to $1,800;

SALARY 2025 How to Calculate CTC, Salary & Tax 2025 New, The child tax credit (ctc) is a provision of the tax code that reduces tax liability up to $2,000 per qualifying child. The maximum tax credit per child is $2,000 for tax year 2025.

Child Tax Credit 2025 How much of your CTC payment is expected in your, At the beginning of march 2025, president biden’s proposed budget for 2025 includes a plan to renew and expand the child tax credit, a policy that has gained. Among households with children, about 95 percent of the benefits of the ctc expansion would go to the bottom two income quintiles (those making up to $40,500.

Central Texas College For Students Of The Real World, The refundable portion of that (actc) maxes at $1,600 per child under current law. The ctc cut child poverty in half in 2025 to.

2025 Child Tax Credits Paar, Melis & Associates, P.C, Under the tax relief for american families and workers act of 2025, the refundable child tax credit would increase to $1,800 per child, with additional increases. Ctc = (monthly salary * basic salary ratio + monthly salary * hra ratio +.

Earned Credit 2025 Chart Hot Sex Picture, The child tax credit ( ctc ) will reset from a maximum of $3,600 to $2,000 per child for 2025 and. These are the income guidelines and credit amounts to claim the earned income tax.

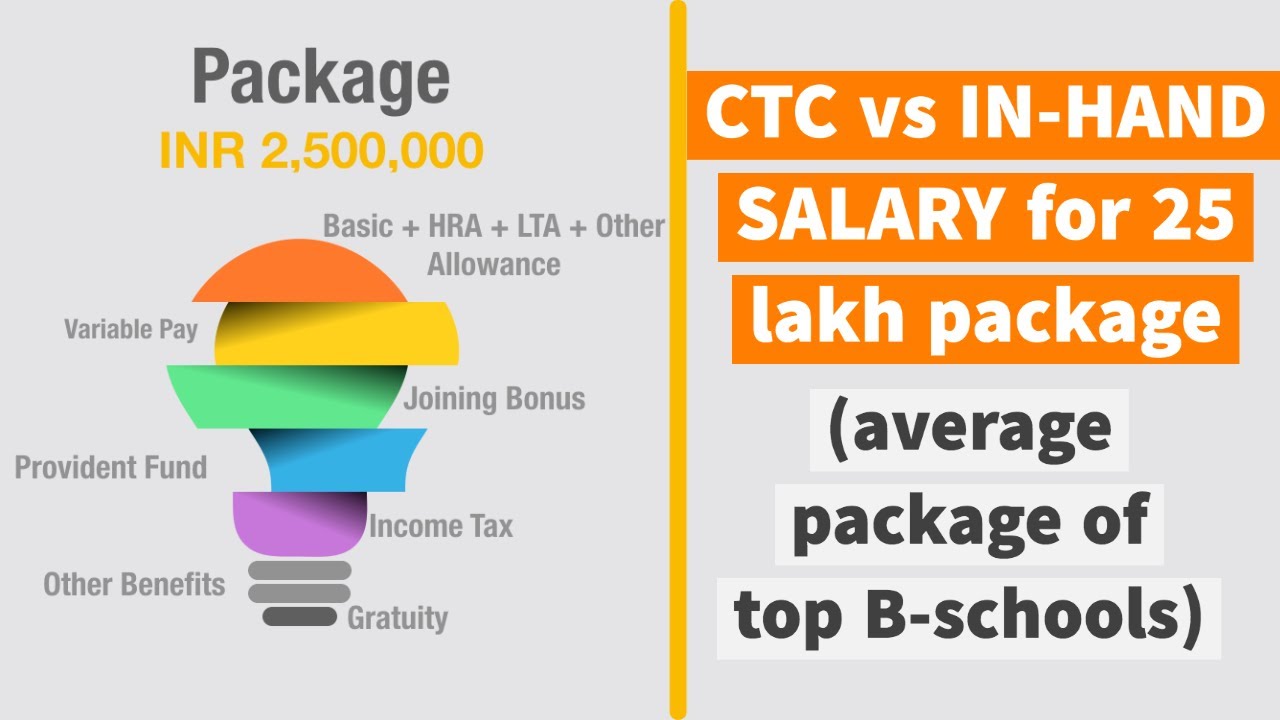

CTC Vs Actual Takehome salary I Reality of 25 Lakh Package in India, The ctc cut child poverty in half in 2025 to. The credit would be adjusted for inflation starting in 2025, which is expected to bump up the maximum credit to $2,100 per child in 2025, up from the current $2,000,.

How much CTC is average according to current situa… Fishbowl, The new rules would increase the maximum refundable amount from $1,600 per child. For the 2025 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700.

What is CTC? Cost to Company Meaning Akrivia HCM, Under the tax relief for american families and workers act of 2025, the refundable child tax credit would increase to $1,800 per child, with additional increases. Under the provision, the maximum refundable amount per child would rise to $1,800 in 2025, $1,900 in 2025 and $2,000 in 2025.